- Home

- Heparin Market

Heparin Market by Type (Low Molecular Weight Heparin, Ultra-Low Molecular Weight Heparin, and Unfractionated Heparin), By Route of Administration (Intravenous and Subcutaneous) By Application (Venous Thromboembolism, Atrial Fibrillation, Renal Impairment, Coronary Artery Disease, and Others) By End-use (Outpatient and Inpatient) By Source (Porcine, Bovine, and Others): Global Opportunity Analysis and Industry Forecast, 2022-2031

- Published Date: January, 2024 | Report ID: CLS-2097 | No of pages: 250 | Format:

The Heparin market was valued at $7.3 billion in 2022. It is projected to grow at a CAGR of 3.1% from 2023 to 2031 and reach more than $9.4 billion by the end of 2031.

Analysts’ Viewpoint by Cognate Lifesciences

According to industry analysts, the global Heparin market is expected to see significant growth in the coming years, driven by several factors including an increasing prevalence of cardiovascular diseases, deep vein thrombosis, and pulmonary embolism. The rising aging population globally, coupled with a surge in surgical procedures, particularly in emerging economies, is expected to boost the demand for heparin as an anticoagulant. The growing awareness about the importance of prophylaxis against thromboembolic disorders and advancements in heparin formulations, such as low molecular weight heparin (LMWH), further contribute to market growth.

Moreover, the expanding applications of heparin beyond traditional uses, such as in the treatment of cancer and inflammatory disorders, are anticipated to open up new avenues for market expansion. The increasing incidence of chronic diseases, diabetes, and kidney-related disorders also underscores heparin's role in various medical treatments. Additionally, ongoing research and development activities, technological innovations, and the introduction of biosimilar heparin products are likely to contribute to the market's positive outlook. While these factors propel the growth of the global heparin market, challenges such as the risk of heparin-induced thrombocytopenia (HIT), regulatory complexities, and the emergence of alternative anticoagulants pose potential hurdles. Nonetheless, the overall trajectory of the heparin market remains optimistic, driven by the crucial role this anticoagulant plays in addressing a spectrum of medical conditions.

Heparin Overview

The global heparin market presents a dynamic landscape characterized by significant growth prospects and evolving factors. Key contributors to the market's expansion include the increasing incidence of cardiovascular diseases, deep vein thrombosis, and pulmonary embolism. As the global population ages and surgical procedures become more prevalent, the demand for heparin, a vital anticoagulant, is on the rise. A noteworthy aspect propelling market growth is the heightened awareness regarding the importance of prophylaxis against thromboembolic disorders. Advances in heparin formulations, particularly low molecular weight heparin (LMWH), add another dimension to its application. Beyond traditional uses, heparin finds expanded roles in treating conditions such as cancer and inflammatory disorders, diversifying its market applications.

Furthermore, the growing prevalence of chronic diseases, diabetes, and kidney-related disorders underscores heparin's significance in various medical treatments. Ongoing research and development activities, technological innovations, and the emergence of biosimilar heparin products contribute to the market's positive trajectory. However, challenges, including the risk of heparin-induced thrombocytopenia (HIT), regulatory complexities, and the advent of alternative anticoagulants, necessitate careful consideration. Despite these challenges, the heparin market remains optimistic, driven by its indispensable role in addressing a spectrum of medical conditions and the continuous pursuit of advancements in anticoagulant therapies.

New product launches to flourish in the market

The Heparin market is expected to see several new product launches in the coming years. Some of the key product launches expected in the Heparin market are:

- Enoxaparin – In June 2023, Enoxaparin Sodium (Enoxaparin) was introduced by Techdow USA Inc., a subsidiary of the Hepalink Group. This vital product is now accessible in seven widely used pre-filled syringe formats, catering to the essential requirement for outpatient management and prevention of detrimental blood clots.

- Par Sterile Products - In July 2023, the Par Sterile Products business of Endo International initiated the distribution of bivalirudin injection in a convenient ready-to-use format, featuring a 250 mg/50 mL single-use vial. This particular product holds distinction as the exclusive liquid formulation of bivalirudin accessible in the United States.

Segment Overview:

By Type: The Heparin market is divided into low molecular weight heparin, ultra-low molecular weight heparin, and unfractionated heparin. Low-Molecular-Weight Heparin (LMWH) commands the largest share, constituting approximately 65% of the Heparin market. This notable dominance can be attributed to several key factors. Firstly, LMWHs demonstrate established efficacy and safety profiles, particularly in managing various thromboembolic conditions. This track record positions them as preferred anticoagulants, striking a balance between effectiveness and a reduced risk of bleeding compared to unfractionated heparin (UFH).

Secondly, the broader application range of LMWHs significantly contributes to their substantial market share. LMWHs find utility in a wider spectrum of indications when compared to Unfractionated Low-Molecular-Weight Heparins (ULMWHs), enhancing their overall market presence. This versatility in application underscores the adaptability of LMWHs, making them a preferred choice across diverse clinical scenarios. In conclusion, the dominance of LMWHs in the Heparin market can be attributed to their proven efficacy, safety, and versatility in addressing a broad range of thromboembolic conditions. These factors position LMWHs as a cornerstone within the anticoagulant market segment.

By Route of Administration: The Heparin market is segmented into intravenous and subcutaneous. The Intravenous segment retains the largest market share, constituting approximately 70% despite the notable growth of the subcutaneous segment. This dominance within the Heparin market is influenced by several key factors. The faster onset of action associated with intravenous administration plays a pivotal role. Intravenous delivery ensures a quicker therapeutic effect, proving to be critical in the management of acute thromboembolic events. This rapid onset of action aligns with the urgent nature of certain medical conditions, making intravenous heparins indispensable in time-sensitive scenarios. Additionally, the prevalence of established protocols and expertise in intravenous heparin administration contributes significantly to its market dominance. Healthcare professionals possess extensive experience and readily available infrastructure for administering heparins intravenously. This familiarity with intravenous protocols ensures efficiency and precision in therapeutic delivery, further solidifying the preference for intravenous heparins. Certain medical conditions inherently necessitate intravenous delivery, sustaining the demand for intravenous heparins. Severe cases and specific clinical scenarios may specifically require the rapid and controlled administration offered by the intravenous route.

In conclusion, the dominance of intravenously administered heparins is driven by their faster onset of action, the presence of established protocols, and the intrinsic demand for intravenous delivery in certain medical conditions. These factors collectively position intravenous heparins as a cornerstone within the Heparin market segment.

By Application: The Heparin market is segmented into venous thromboembolism, atrial fibrillation, renal impairment, coronary artery disease, and others. The Atrial Fibrillation (AFib) application segment currently commands the largest share within the Heparin market, accounting for approximately 40%. This substantial dominance within the market can be attributed to several key factors. The high prevalence of Atrial Fibrillation and its associated risks play a pivotal role in securing its majority share. AFib is a widespread cardiovascular condition, and the heightened risk of stroke complications necessitates effective anticoagulation. The critical role of anticoagulants in mitigating stroke risks aligns with the overarching objective of managing AFib, contributing significantly to the prominence of heparin in this application. Additionally, the established role of heparin in AFib management further solidifies its market position. Historically utilized and continuing to be a standard of care for certain types of AFib, heparin enjoys a well-entrenched status in the management of this cardiovascular condition. This historical reliability contributes to the sustained preference for heparin in AFib treatment protocols.

Moreover, limited competition in certain settings enhances heparin's dominance within the AFib segment. For specific subsets of high-risk AFib patients undergoing procedures or those with particular co-morbidities, heparin may be preferred over other anticoagulant options. This limited competition reinforces the role of heparin as a preferred choice in specific clinical scenarios, further contributing to its significant market share in the AFib application. Therefore, the dominance of heparin in the Atrial Fibrillation segment is underpinned by the high prevalence of AFib, the established role of heparin in its management, and the limited competition in certain clinical settings. These factors collectively position heparin as a key player in addressing the anticoagulation needs of patients with Atrial Fibrillation.

By End Use: The Heparin market is segmented into outpatient and inpatient. The inpatient settings segment currently commands the largest share within the Heparin market, accounting for approximately 75%, despite the notable growth of the outpatient segment. This dominance within the market is influenced by several key factors. The prevalence of severe cases and specific medical needs plays a crucial role. Patients experiencing acute thromboembolic events or those requiring close monitoring often necessitate inpatient care, where intravenous heparin administration can be effectively managed. The urgency and critical nature of certain medical conditions align with the need for inpatient settings, sustaining the demand for heparin in these environments. Secondly, the presence of established protocols and expertise in hospitals significantly contributes to the dominance of inpatient settings. Healthcare professionals in hospital settings possess extensive experience and readily available infrastructure for administering heparin through various routes, including intravenous administration. This familiarity with inpatient protocols ensures efficient and precise therapeutic delivery, reinforcing the preference for inpatient care in heparin administration.

Limited access to outpatient options reinforces the dominance of inpatient settings. Certain formulations or monitoring requirements may not be readily available or easily managed in outpatient settings, further emphasizing the need for inpatient care in specific clinical scenarios. In conclusion, the dominance of inpatient settings in the Heparin market is driven by the prevalence of severe cases, the established protocols and expertise in hospital settings, and the limited access to outpatient options for certain formulations or monitoring requirements. These factors collectively position inpatient settings as a cornerstone within the Heparin market segment.

By Source: The Heparin market is segmented into porcine, bovine, and others. Porcine-derived heparin currently commands the largest share within the Heparin market, accounting for approximately 55%, despite the rapid growth of alternative sources. This dominance within the market is influenced by several key factors. The established availability and infrastructure for porcine-derived heparin play a pivotal role. Extensive supply chains and well-established production processes make porcine heparin readily available, providing economies of scale. The long-standing tradition of utilizing porcine sources has created a reliable and efficient supply chain that contributes significantly to the dominance of porcine-derived heparin. Additionally, the cost-effectiveness of porcine-derived heparin compared to alternative options is a critical factor. For certain applications, porcine heparin remains a cost-competitive option, particularly when compared to newer approaches such as recombinant or synthetic heparin. This cost-effectiveness enhances its attractiveness, especially in scenarios where economic considerations play a crucial role in decision-making.

Moreover, the suitability of porcine-derived heparin for specific formulations contributes to its dominance. Some heparin formulations and dosage forms may be better suited for production using porcine sources, emphasizing the practicality and compatibility of porcine-derived heparin in certain applications. In conclusion, the dominance of porcine-derived heparin in the market is driven by its established availability and infrastructure, cost-effectiveness compared to alternative options, and suitability for specific formulations. These factors collectively position porcine-derived heparin as a key player within the Heparin market segment.

By Region:

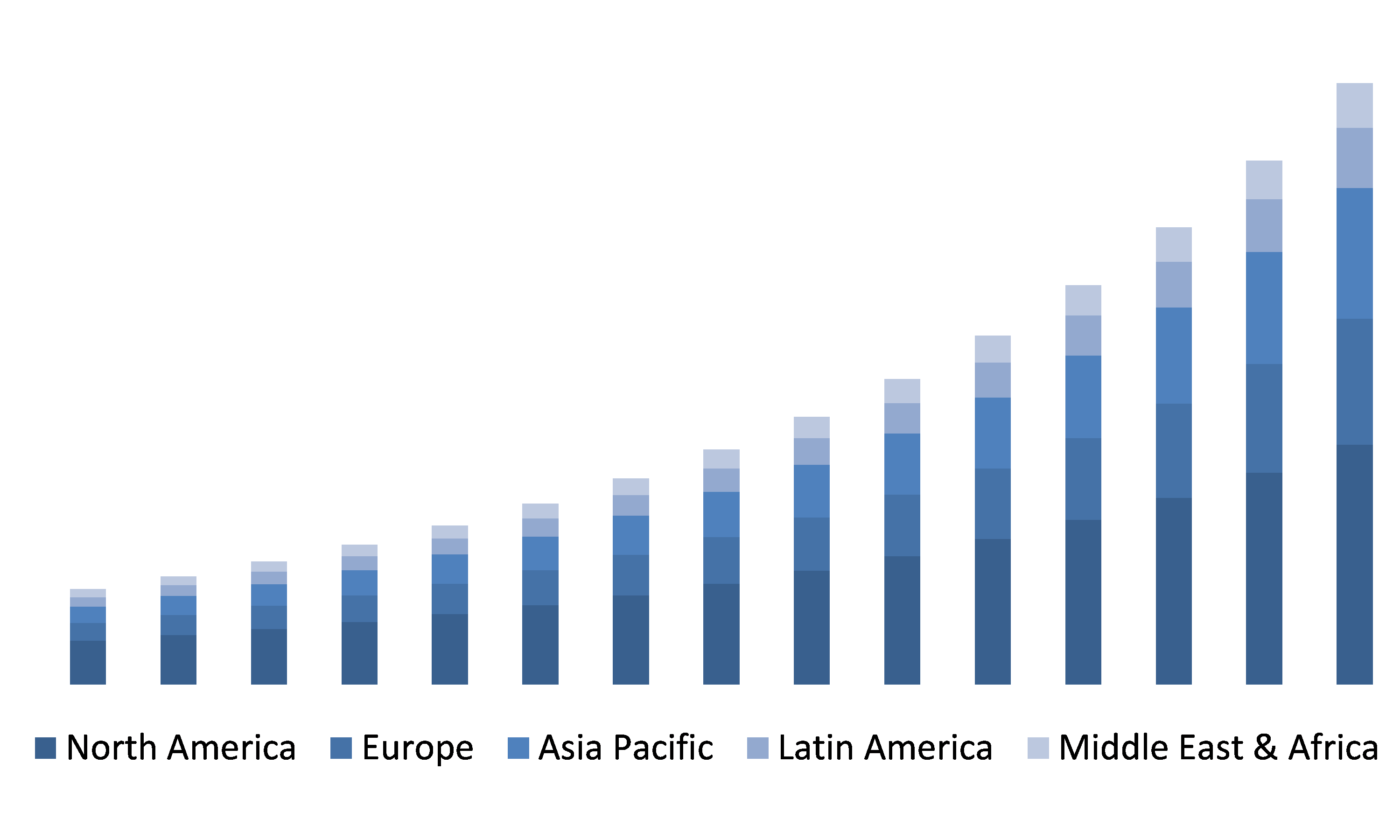

In 2023, North America emerged as the dominant force in the market, securing a substantial 38.6% share. This dominance is propelled by factors such as increasing patient awareness, a high disease burden, proactive governmental initiatives, technological advancements, and enhancements in healthcare infrastructure. The region's market growth is further catalyzed by the influential presence of key industry players. A CDC article published in May 2023 highlighted that heart disease is the leading cause of death in the U.S., with a staggering statistic of one death every 33 seconds. This alarming prevalence underscores the critical role of heparin, a pivotal anticoagulant, in the management and treatment of cardiovascular conditions, thereby contributing significantly to the sustained demand within the market.

From 2024 to 2030, the Asia Pacific region is poised to experience the most rapid Compound Annual Growth Rate (CAGR). Cardiovascular diseases emerge as the primary cause of death and disability in this region, imposing a considerable economic burden on healthcare systems. A June 2023 article from the NCBI, titled "The report on cardiovascular health and diseases in China 2021: an updated summary," emphasizes this significant challenge. The report reveals that approximately 330 million individuals in China alone are grappling with various cardiovascular conditions, highlighting the urgent need for interventions and solutions to address this widespread health issue.

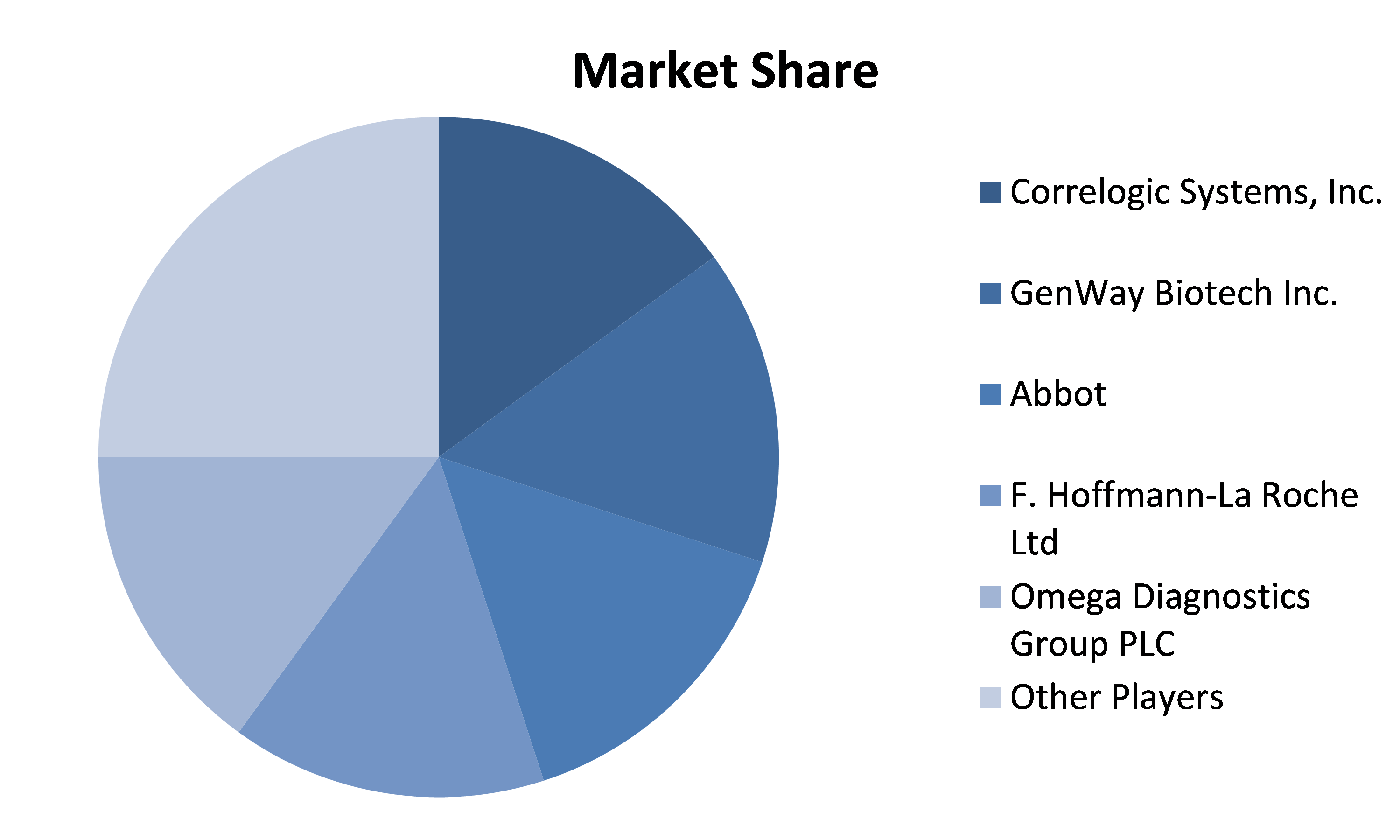

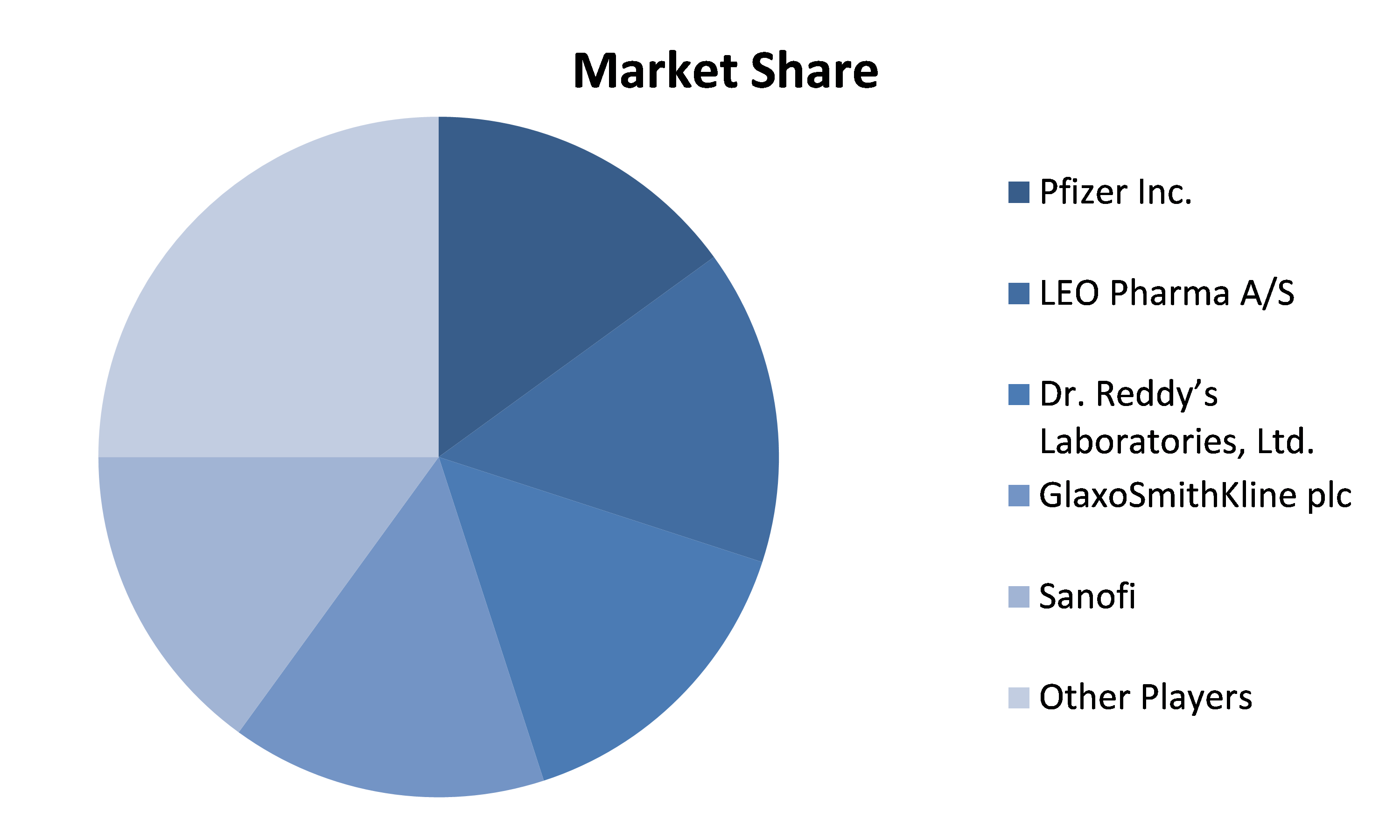

Competitive analysis and profiles of the major players in the Heparin market, such as Pfizer Inc., LEO Pharma A/S, Dr. Reddy’s Laboratories, Ltd., GlaxoSmithKline plc, Sanofi, Aspen Holdings, Fresenius SE & Co., KGaA, B. Braun Medical, Inc., Sandoz (Novartis AG). Major players have adopted product launch and acquisition as key developmental strategies to improve the product portfolio of the Heparin market.

Competitive analysis and profiles of the major players in the Heparin market, such as Pfizer Inc., LEO Pharma A/S, Dr. Reddy’s Laboratories, Ltd., GlaxoSmithKline plc, Sanofi, Aspen Holdings, Fresenius SE & Co., KGaA, B. Braun Medical, Inc., Sandoz (Novartis AG). Major players have adopted product launch and acquisition as key developmental strategies to improve the product portfolio of the Heparin market.

Market Scope and Structure Analysis

|

Report Metric |

Details |

|

Market Size Available for Years |

2021–2031 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2031 |

|

Forecast Unit |

Value (USD) |

|

Segments Covered |

By type, route of administration, application, end-use, source, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

|

Companies Covered |

|

Key Segments Covered

Type

- Low Molecular Weight Heparin

- Ultra-Low Molecular Weight Heparin

- Unfractionated Heparin

Route of Administration

- Intravenous

- Subcutaneous

Application

- Venous Thromboembolism

- Atrial Fibrillation

- Renal Impairment

- Coronary Artery Disease

- Others

End-use

- Outpatient

- Inpatient

Source

- Porcine

- Bovine

- Others

Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Israel

- Rest of Middle East & Africa

TABLE OF CONTENT

- Research Methodology

- Desk Research

- Real-time insights and validation

- Forecast model

- Assumptions and forecast parameters

- Assumptions

- Forecast parameters

- Data sources

- Primary

- Secondary

- Executive Summary

- 360° summary

- By Type trends

- By End-Use trends

- Market Overview

- Market segmentation & definitions

- Key takeaways

- Top investment pockets

- Top winning strategies

- Porter’s five forces analysis

- Bargaining power of consumers

- Bargaining power of suppliers

- Threat of new entrants

- Threat of substitutes

- Competitive rivalry in the market

- Market dynamics

- Drivers

- Restraints

- Opportunities

- Technology landscape

- Pipeline Analysis

- Regulatory landscape

- Patent landscape

- Market value chain analysis

- Strategic overview

- Heparin Market, by Type

- Low Molecular Weight Heparin

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Ultra-Low Molecular Weight Heparin

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Unfractionated Heparin

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Low Molecular Weight Heparin

- Heparin Market, by Route of Administration

- Intravenous

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Subcutaneous

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Intravenous

- Heparin Market, by Application

- Venous Thromboembolism

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Atrial Fibrillation

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Renal Impairment

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Coronary Artery Disease

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Others

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Venous Thromboembolism

- Heparin Market, by End-Use

- Outpatient

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Inpatient

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Outpatient

- Heparin Market, by Source

- Porcine

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Bovine

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Others

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Porcine

- Heparin Market, by Region

- North America

- Market size and forecast, by Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Market size and forecast, by Source, 2022-2031

- Market size and forecast, by country, 2022-2031

- Comparative market share analysis, 2022 & 2031

- U.S.

- Market size and forecast, by Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Market size and forecast, by Source, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Canada

- Market size and forecast, by Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Market size and forecast, by Source, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Europe

- Market size and forecast, by Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Market size and forecast, by Source, 2022-2031

- Market size and forecast, by country, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Germany

- Market size and forecast, by Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Market size and forecast, by Source, 2022-2031

- Comparative market share analysis, 2022 & 2031

- UK

- Market size and forecast, by Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Market size and forecast, by Source, 2022-2031

- Comparative market share analysis, 2022 & 2031

- France

- Market size and forecast, by Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Market size and forecast, by Source, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Spain

- Market size and forecast, by Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Market size and forecast, by Source, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Italy

- Market size and forecast, by Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Market size and forecast, by Source, 2022-2031

- Comparative market share analysis, 2022 & 2031

- North America

-

-

- Rest of Europe

- Market size and forecast, by Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Market size and forecast, by Source, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Rest of Europe

- Asia Pacific

- Market size and forecast, by Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Market size and forecast, by Source, 2022-2031

- Market size and forecast, by country, 2022-2031

- Comparative market share analysis, 2022 & 2031

- China

- Market size and forecast, by Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Market size and forecast, by Source, 2022-2031

- Comparative market share analysis, 2022 & 2031

- India

- Market size and forecast, by Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Market size and forecast, by Source, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Australia

- Market size and forecast, by Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Market size and forecast, by Source, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Rest of Asia Pacific

- Market size and forecast, by Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Market size and forecast, by Source, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Latin America

- Market size and forecast, by Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Market size and forecast, by Source, 2022-2031

- Market size and forecast, by country, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Brazil

- Market size and forecast, by Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Market size and forecast, by Source, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Mexico

- Market size and forecast, by Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Market size and forecast, by Source, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Argentina

- Market size and forecast, by Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Market size and forecast, by Source, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Rest of Latin America

- Market size and forecast, by Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Market size and forecast, by Source, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Middle East and Africa

- Market size and forecast, by Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Market size and forecast, by Source, 2022-2031

- Market size and forecast, by country, 2022-2031

- Comparative market share analysis, 2022 & 2031

- UAE

- Market size and forecast, by Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Market size and forecast, by Source, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Saudi Arabia

- Market size and forecast, by Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Market size and forecast, by Source, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Israel

- Market size and forecast, by Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Market size and forecast, by Source, 2022-2031

- Comparative market share analysis, 2022 & 2031

- South Africa

- Market size and forecast, by Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Market size and forecast, by Source, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Rest of Middle East and Africa

- Market size and forecast, by Type, 2022-2031

- Market size and forecast, by Route of Administration, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Market size and forecast, by Source, 2022-2031

- Comparative market share analysis, 2022 & 2031

-

- Company profiles

- Pfizer Inc.

- Business overview

- Financial performance

- Product portfolio

- Recent strategic moves & developments

- SWOT analysis

- LEO Pharma A/S

- Business overview

- Financial performance

- Product portfolio

- Recent strategic moves & developments

- SWOT analysis

- Dr. Reddy’s Laboratories, Ltd.

- Business overview

- Financial performance

- Product portfolio

- Recent strategic moves & developments

- SWOT analysis

- GlaxoSmithKline plc

- Business overview

- Financial performance

- Product portfolio

- Recent strategic moves & developments

- SWOT analysis

- Sanofi

- Business overview

- Financial performance

- Product portfolio

- Recent strategic moves & developments

- SWOT analysis

- Aspen Holdings

- Business overview

- Financial performance

- Product portfolio

- Recent strategic moves & developments

- SWOT analysis

- Fresenius SE & Co., KGaA

- Business overview

- Financial performance

- Product portfolio

- Recent strategic moves & developments

- SWOT analysis

- B. Braun Medical, Inc.

- Business overview

- Financial performance

- Product portfolio

- Recent strategic moves & developments

- SWOT analysis

- Sandoz (Novartis AG)

- Business overview

- Financial performance

- Product portfolio

- Recent strategic moves & developments

- SWOT analysis

- Other Prominent Players

- Business overview

- Financial performance

- Product portfolio

- Recent strategic moves & developments

- SWOT analysis

- Pfizer Inc.

Segmentation

Key Segments Covered

Type

- Low Molecular Weight Heparin

- Ultra-Low Molecular Weight Heparin

- Unfractionated Heparin

Route of Administration

- Intravenous

- Subcutaneous

Application

- Venous Thromboembolism

- Atrial Fibrillation

- Renal Impairment

- Coronary Artery Disease

- Others

End-use

- Outpatient

- Inpatient

Source

- Porcine

- Bovine

- Others

Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Israel

- Rest of Middle East & Africa

Methodology

Get your pre and post sales queries resolved by our Subject matter experts.

We will assist you to customize the report to fit your research needs.

Our prime focus is to provide qualitative and accurate data.

Feel free to order a sample report before purchase.

Your personal and confidential information is safe and secured.

© 2024 Cognate Lifesciences. All Rights Reserved.