- Home

- Femtech Market

Femtech Market by Product (Diagnostics, Monitoring, Therapeutic, Consumer Products), By Application (General Health and Wellness, Maternity Care, Menstrual Health, Pelvic and Uterine Healthcare, Cancer and Chronic Disease) By End-use (Direct-to-consumer, Hospitals, Surgical Centers, Fertility Clinics, Diagnostics Centers): Global Opportunity Analysis and Industry Forecast, 2022-2031

- Published Date: January, 2024 | Report ID: CLS-2096 | No of pages: 250 | Format:

The Femtech market was valued at $6.1 billion in 2022. It is projected to grow at a CAGR of 11.2% from 2023 to 2031 and reach more than $13.4 billion by the end of 2031.

Analysts’ Viewpoint by Cognate Lifesciences

According to industry analysts, the global Femtech market is expected to see significant growth in the coming years, driven by several factors including a heightened focus on women's health, increasing awareness, and technological advancements. Industry analysts anticipate that the global Femtech market will experience substantial growth in the coming years, propelled by various key factors. One of the primary drivers is the heightened emphasis on women's health, with a growing recognition of the unique healthcare needs of women across different life stages. The increased awareness and acceptance of Femtech solutions, spanning areas such as fertility tracking, pregnancy monitoring, and menstrual health management, are contributing to the market's expansion.

In 2023, analysts express an optimistic viewpoint on the Femtech market, highlighting its unprecedented growth and transformative impact on women's healthcare. The intersection of technology and women's health is poised to revolutionize how healthcare services are delivered, offering innovative solutions for issues ranging from fertility tracking to menstrual health. The increasing adoption of digital health platforms, wearables, and mobile applications specifically designed for women underscores a shifting paradigm in personalized healthcare. Analysts anticipate a surge in investment and collaborations within the Femtech sector, driven by a growing awareness of women's health needs and a favorable regulatory environment. The market's potential to address previously underserved aspects of women's well-being, such as menopause and pelvic health, further solidifies its promising trajectory. With a focus on empowering women through accessible and user-friendly technology, the Femtech market is positioned to become a vital component of the broader healthcare landscape, fostering a new era of preventive and proactive women's healthcare solutions.

Femtech Overview

Rising awareness and proactive engagement with women's health concerns, alongside the normalization of addressing these issues, are key drivers for the anticipated robust growth in the market. Favorable factors include an upswing in disposable income, heightened digital literacy, widespread smartphone usage, increased internet connectivity, and the establishment of a robust digital health infrastructure. Moreover, the burgeoning presence of startups specifically dedicated to women's health underscores a wealth of opportunities for both new and established market players. The market is further propelled by the growing availability and adoption of smart wearable devices, amplifying its overall development. Recognizing the untapped potential, health tech developers and investors are channeling resources into innovative product development strategies, ensuring a proactive approach to addressing diverse women's health issues. This convergence of factors not only creates a lucrative landscape but also signifies a transformative phase in healthcare, emphasizing personalized and accessible solutions for women's well-being.

Technological advancements play a pivotal role, with innovations such as wearable devices, mobile applications, and digital health platforms catering specifically to women's health needs. These technological solutions offer greater accessibility and convenience, empowering women to take proactive control of their well-being. Additionally, the favorable regulatory environment and a surge in investment further facilitate the Femtech market's growth, fostering an ecosystem where innovation and development thrive.

New product launches to flourish in the market

The Femtech market is expected to see several new product launches in the coming years. Some of the key product launches expected in the Femtech market are:

- MyBreastAi platform – In November 2023, GE launched the MyBreastAi platform. The platform offers AI capabilities in mammography. The launch of MyBreastAi marks a significant step forward in the fight against breast cancer. By incorporating AI into the diagnostic process, GE Healthcare is hoping to improve outcomes for women around the world.

- FemTech Hub - In November 2022, FemTech Lab launched an innovation space for the FemTech community. The Hub offers a dedicated physical space specifically designed to cater to the unique needs of FemTech ventures. This fosters a sense of community, collaboration, and knowledge sharing among entrepreneurs, investors, and other stakeholders in the FemTech ecosystem.

Segment Overview:

By Product: The Femtech market is divided into diagnostics, monitoring, therapeutic, and consumer products. The dominating segment of the Femtech market is consumer products. This segment is expected to account for the largest share of the market in the coming years. Consumer Products: This segment, encompassing menstrual products, sexual wellness toys, and general wellness products, currently holds the largest market share within Femtech. It is driven by factors like rising disposable incomes, increasing access to information, and a shift towards more natural and sustainable feminine hygiene options. Increased financial empowerment of women translates to greater willingness to invest in their health and well-being. This opens doors for premium menstrual products, innovative sexual wellness toys, and personalized wellness tools that cater to specific needs and preferences. The dynamic nature of consumer products within Femtech means the future holds even more exciting possibilities. We can expect further personalization, tech integration, and a continued focus on sustainability and inclusivity. This segment is not only driving the Femtech market, but also empowering women to take charge of their health and well-being in a holistic and informed manner.

By Application: The Femtech market is segmented into general health and wellness, maternity care, menstrual health, pelvic and uterine healthcare, and cancer and chronic disease. The general health and wellness segment is expected to dominate the Femtech market in the coming years. This broad category encompasses products and services for various aspects of women's well-being, including fitness trackers, nutrition apps, mental health platforms, and sleep monitoring devices. It currently holds the largest market share within Femtech due to its universality and appeal to a wide range of women. The widespread appeal of General Health and Wellness in Femtech stems from its universal applicability. It offers solutions for every woman, regardless of age, health status, or fitness level. Additionally, its focus on prevention, empowerment, and self-care resonates deeply with the modern woman who prioritizes holistic well-being.

By End-use: The Femtech market is segmented into direct-to-consumer, hospitals, surgical centers, fertility clinics, and diagnostics centers. The direct-to-consumer segment is expected to dominate the Femtech market in the coming years. This segment encompasses Femtech products and services readily accessible to women through online and offline retail channels. It currently holds the largest market share due to its convenience, affordability, and wide range of offerings, from menstrual cups and period trackers to fitness apps and self-care tools. The DTC Femtech revolution is about reclaiming power and agency for women. It's about convenience, choice, and building a community of support around personalized solutions for diverse health needs. As technology evolves and consumer preferences shift, we can expect even more innovative products and services to emerge within the DTC landscape, further empowering women to embrace their health and well-being on their own terms.

By Region:

The North American region is projected to maintain its dominance in the global Femtech market. In 2022, it held the largest revenue share of over 35%. North America has been at the forefront of Femtech innovation, with early adoption of pioneering Femtech products and services. Increased awareness about women's health issues and a willingness to embrace tech-driven solutions further fuel market growth. The region boasts a well-developed venture capital ecosystem with a growing focus on Femtech startups. This translates to ample funding for innovation and the establishment of a robust infrastructure for Femtech product development and commercialization. The global Femtech landscape is dynamic and constantly evolving. While North America currently leads the pack, the future holds immense promise for Femtech advancements and broader market penetration across all regions. As technology continues to advance and awareness about women's health grows, we can expect Femtech solutions to empower women worldwide and revolutionize healthcare for generations to come.

The Asia Pacific region is poised to experience the most rapid growth in the global Femtech market during the forecast period. The Asia-Pacific region boasts a highly tech-savvy population, particularly among younger generations. This translates to a greater willingness to embrace and adopt new technologies, including Femtech solutions. As economies across the region experience steady growth, disposable incomes are increasing, enabling women to invest in their health and well-being through Femtech products and services. The future of Femtech in Asia-Pacific is bright. With its vast potential, supportive ecosystem, and diverse needs, the region is poised to be a world leader in Femtech innovation and market growth. Expect to see exciting advancements in personalized healthcare, culturally relevant solutions, and improved access to technology for women across the region.

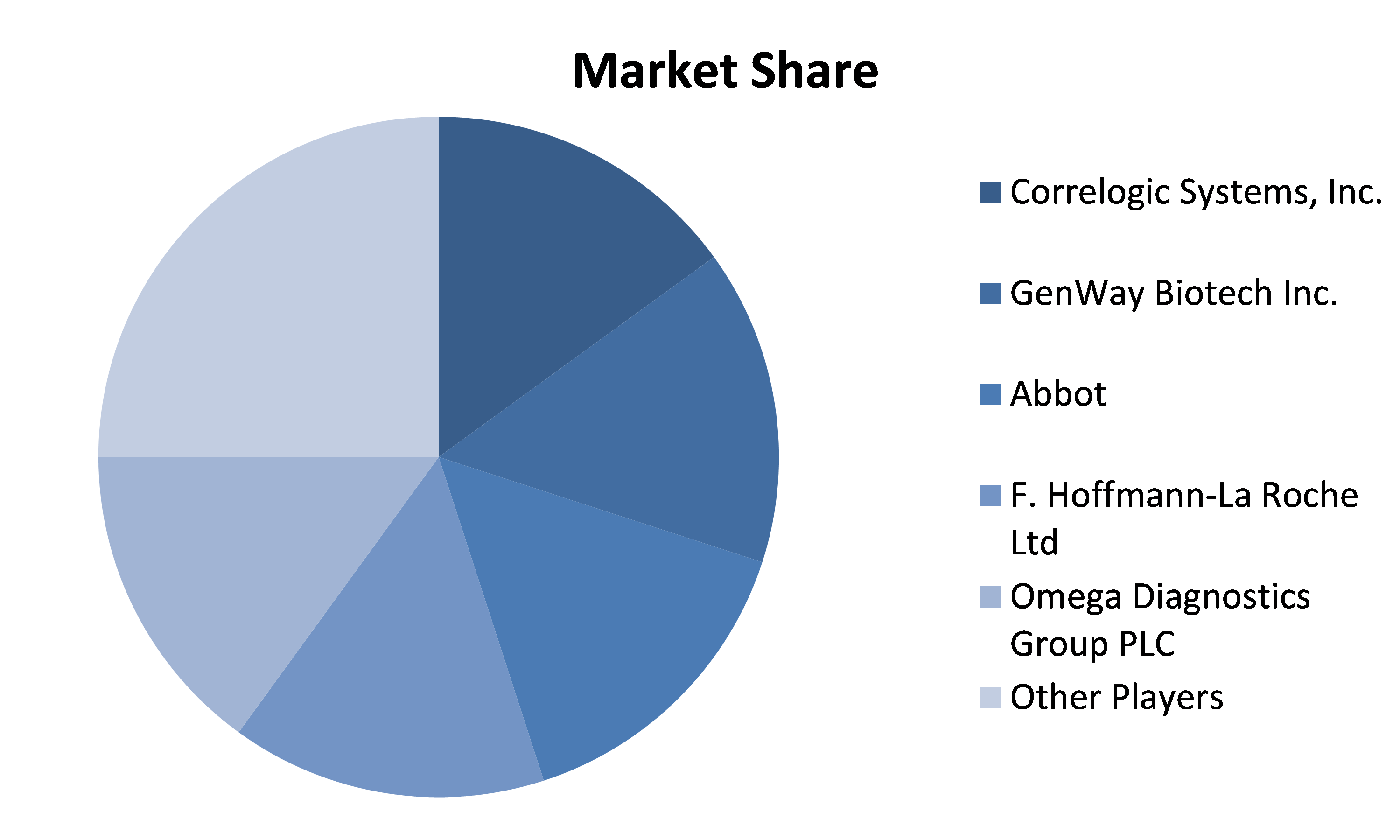

Competitive analysis and profiles of the major players in the Femtech market, such as Flo Health Inc., Apple Inc., Clue by Biowink GmbH, Glow Inc., Google Inc., Natural Cycles USA Corp, Withings, Fitbit Inc. Major players have adopted product launch and acquisition as key developmental strategies to improve the product portfolio of the Femtech market.

Market Scope and Structure Analysis

|

Report Metric |

Details |

|

Market Size Available for Years |

2021–2031 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2031 |

|

Forecast Unit |

Value (USD) |

|

Segments Covered |

By product, application, end-use, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

|

Companies Covered |

|

Key Segments Covered

Product

- Diagnostics

- Monitoring

- Therapeutic

- Consumer Products

Application

- General Health and Wellness

- Maternity Care

- Menstrual Health

- Pelvic and Uterine Healthcare

- Cancer and Chronic Disease

End-use

- Direct-to-consumer

- Hospitals

- Surgical Centers

- Fertility Clinics

- Diagnostics Centers

Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Israel

- Rest of Middle East & Africa

TABLE OF CONTENT

- Research Methodology

- Desk Research

- Real-time insights and validation

- Forecast model

- Assumptions and forecast parameters

- Assumptions

- Forecast parameters

- Data sources

- Primary

- Secondary

- Executive Summary

- 360° summary

- By Product trends

- By End-Use trends

- Market Overview

- Market segmentation & definitions

- Key takeaways

- Top investment pockets

- Top winning strategies

- Porter’s five forces analysis

- Bargaining power of consumers

- Bargaining power of suppliers

- Threat of new entrants

- Threat of substitutes

- Competitive rivalry in the market

- Market dynamics

- Drivers

- Restraints

- Opportunities

- Technology landscape

- Pipeline Analysis

- Regulatory landscape

- Patent landscape

- Market value chain analysis

- Strategic overview

- Femtech Market, by Product

- Diagnostics

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Monitoring

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Therapeutic

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Consumer Products

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Diagnostics

- Femtech Market, by Application

- General Health and Wellness

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Maternity Care

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Menstrual Health

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Pelvic and Uterine Healthcare

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Cancer and Chronic Disease

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- General Health and Wellness

- Femtech Market, by End-Use

- Direct-to-consumer

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Hospitals

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Surgical Centers

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Fertility Clinics

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Diagnostics Centers

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Direct-to-consumer

- Femtech Market, by Region

- North America

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Market size and forecast, by country, 2022-2031

- Comparative market share analysis, 2022 & 2031

- U.S.

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Canada

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Europe

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Market size and forecast, by country, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Germany

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- UK

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- France

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Spain

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Italy

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- North America

-

-

- Rest of Europe

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Rest of Europe

- Asia Pacific

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Market size and forecast, by country, 2022-2031

- Comparative market share analysis, 2022 & 2031

- China

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- India

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Australia

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Rest of Asia Pacific

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Latin America

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Market size and forecast, by country, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Brazil

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Mexico

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Argentina

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Rest of Latin America

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Middle East and Africa

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Market size and forecast, by country, 2022-2031

- Comparative market share analysis, 2022 & 2031

- UAE

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Saudi Arabia

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Israel

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- South Africa

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Rest of Middle East and Africa

- Market size and forecast, by Product, 2022-2031

- Market size and forecast, by Application, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Comparative market share analysis, 2022 & 2031

-

- Company profiles

- Flo Health Inc.

- Business overview

- Financial performance

- Product portfolio

- Recent strategic moves & developments

- SWOT analysis

- Apple Inc.

- Business overview

- Financial performance

- Product portfolio

- Recent strategic moves & developments

- SWOT analysis

- Clue by Biowink GmbH

- Business overview

- Financial performance

- Product portfolio

- Recent strategic moves & developments

- SWOT analysis

- Glow Inc.

- Business overview

- Financial performance

- Product portfolio

- Recent strategic moves & developments

- SWOT analysis

- Google Inc.

- Business overview

- Financial performance

- Product portfolio

- Recent strategic moves & developments

- SWOT analysis

- Natural Cycles USA Corp

- Business overview

- Financial performance

- Product portfolio

- Recent strategic moves & developments

- SWOT analysis

- Withings

- Business overview

- Financial performance

- Product portfolio

- Recent strategic moves & developments

- SWOT analysis

- Fitbit Inc.

- Business overview

- Financial performance

- Product portfolio

- Recent strategic moves & developments

- SWOT analysis

- Other Prominent Players

- Business overview

- Financial performance

- Product portfolio

- Recent strategic moves & developments

- SWOT analysis

- Flo Health Inc.

Segmentation

Key Segments Covered

Product

- Diagnostics

- Monitoring

- Therapeutic

- Consumer Products

Application

- General Health and Wellness

- Maternity Care

- Menstrual Health

- Pelvic and Uterine Healthcare

- Cancer and Chronic Disease

End-use

- Direct-to-consumer

- Hospitals

- Surgical Centers

- Fertility Clinics

- Diagnostics Centers

Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Israel

- Rest of Middle East & Africa

Methodology

Get your pre and post sales queries resolved by our Subject matter experts.

We will assist you to customize the report to fit your research needs.

Our prime focus is to provide qualitative and accurate data.

Feel free to order a sample report before purchase.

Your personal and confidential information is safe and secured.

© 2024 Cognate Lifesciences. All Rights Reserved.