- Home

- Carcinoembryonic Antigen Cea Market

Carcinoembryonic Antigen (CEA) Market by Detected Cancer Type (Colorectal Cancer, Pancreatic Cancer, Ovarian Cancer, Breast Cancer, Thyroid Cancer, and Others), By Test Type (Molecular Tests and Serology Tests) By End-use (Hospitals, Laboratories, and Others): Global Opportunity Analysis and Industry Forecast, 2022-2031

- Published Date: January, 2024 | Report ID: CLS-2098 | No of pages: 250 | Format:

The Carcinoembryonic Antigen (CEA) market was valued at $1.9 billion in 2022. It is projected to grow at a CAGR of 1.2% from 2023 to 2031 and reach more than $3.1 billion by the end of 2031.

Analysts’ Viewpoint by Cognate Lifesciences

According to industry analysts, the global Carcinoembryonic Antigen (CEA) market is expected to see significant growth in the coming years, driven by several factors including a rising prevalence of cancer, advancements in diagnostic technologies, and an increasing focus on early cancer detection. The global Carcinoembryonic Antigen (CEA) market is anticipated to experience substantial growth in the foreseeable future. Key drivers of this growth include the escalating incidence of cancer cases worldwide, with CEA serving as a vital biomarker for various types of cancers. Additionally, advancements in diagnostic technologies, especially in the field of immunoassays and tumor marker detection, contribute to the market's expansion. The growing emphasis on early cancer detection and screening programs further fuels the demand for CEA testing. As healthcare systems prioritize proactive measures against cancer, the CEA market is positioned to play a pivotal role in facilitating timely and effective diagnosis. Collaborations, research initiatives, and the development of innovative CEA-based diagnostics are expected to further propel the market's growth, providing clinicians with valuable tools for cancer management.

Carcinoembryonic Antigen (CEA) Overview

The Carcinoembryonic Antigen (CEA) market presents a dynamic landscape with significant growth potential, as highlighted by industry analysts. CEA, a crucial biomarker associated with various types of cancers, is poised to contribute substantially to the global healthcare sector in the coming years.

Key factors driving the anticipated growth include the increasing prevalence of cancer cases worldwide. CEA serves as an important diagnostic tool, aiding in the identification and monitoring of cancer conditions. Advancements in diagnostic technologies, particularly in immunoassays and tumor marker detection, further enhance the market's potential. These technological innovations empower healthcare professionals with more accurate and efficient methods for cancer diagnosis and monitoring. The market's trajectory is also influenced by a growing emphasis on early cancer detection and screening initiatives. As healthcare systems prioritize preventive measures, CEA plays a pivotal role in enabling timely and proactive interventions. The market's expansion aligns with global efforts to improve cancer outcomes through early identification and treatment.

Moreover, the positive growth trajectory of the market is further reinforced by the presence of favorable government initiatives focused on cancer awareness and control. Organizations such as the Cancer Prevention and Control Research Network (CPCRN) and the National Cancer Institute actively contribute to this momentum. The ongoing development of novel biomarkers, particularly those combinable with existing markers, is anticipated to play a crucial role in propelling market expansion. For instance, the utilization of carcinoembryonic antigen in conjunction with mucin tumor markers CA19-9 and CA242 holds promise for preoperative staging, facilitating surgical planning, and informing future management strategies.

The increasing geriatric population, more susceptible to chronic medical conditions, including cancer, is set to broaden the consumer base. Technological advancements in proteomics, encompassing mass spectrometry, protein labeling, array-based approaches, imaging, and protein bioinformatics, have accelerated biomarker discovery and improved understanding of their roles. Furthermore, the continuous evolution of novel immunological techniques, such as radioimmunoassay, is expected to elevate the demand for carcinoembryonic antigen tests in the foreseeable future. Overall, these factors collectively contribute to a positive outlook for the carcinoembryonic antigen market during the forecast period.

New product launches to flourish in the market

The Carcinoembryonic Antigen (CEA) market is expected to see several new product launches in the coming years. Some of the key product launches expected in the Carcinoembryonic Antigen (CEA) market are:

- MyBreastAi platform – In November 2023, GE launched the MyBreastAi platform. The platform offers AI capabilities in mammography. The launch of MyBreastAi marks a significant step forward in the fight against breast cancer. By incorporating AI into the diagnostic process, GE Healthcare is hoping to improve outcomes for women around the world.

- Carcinoembryonic Antigen (CEA) Hub - In November 2022, Carcinoembryonic Antigen (CEA) Lab launched an innovation space for the Carcinoembryonic Antigen (CEA) community. The Hub offers a dedicated physical space specifically designed to cater to the unique needs of Carcinoembryonic Antigen (CEA) ventures. This fosters a sense of community, collaboration, and knowledge sharing among entrepreneurs, investors, and other stakeholders in the Carcinoembryonic Antigen (CEA) ecosystem.

Segment Overview:

By Detected Cancer Type: The Pancreatic Cancer segment is poised to emerge as the fastest-growing segment, projected to attain a remarkable Compound Annual Growth Rate (CAGR) in the forthcoming years. This rapid growth is propelled by several key factors that collectively contribute to the segment's dynamic expansion. The unfortunate escalation in the incidence of pancreatic cancer significantly fuels this growth. Lifestyle factors and improved detection methods contribute to the rising prevalence of pancreatic cancer cases, highlighting the urgent need for effective diagnostic and therapeutic solutions. Additionally, a notable driver is the increasing focus on personalized medicine within the realm of pancreatic cancer. Advancements in molecular diagnostics and tumor profiling have paved the way for more targeted and individualized therapy approaches. The demand for accurate diagnoses is consequently amplified, driving the growth of this segment.

Moreover, concerted efforts towards early detection play a pivotal role in propelling the segment forward. Growing awareness and initiatives specifically geared towards the early identification of pancreatic cancer contribute to an increased demand for sophisticated diagnostic tools. As a result, the segment stands at the forefront of growth, aligning with global endeavors to enhance early detection strategies for improved patient outcomes. The pancreatic cancer segment's projected rapid growth is underpinned by the escalating incidence of the disease, a focus on personalized medicine, and intensified efforts in early detection initiatives. These factors collectively position the segment as a key driver within the broader landscape of cancer diagnostics and therapeutics.

By Test Type: Serology Tests currently command the largest market share, accounting for approximately 60%. This dominance within the market is attributed to several key factors that collectively underscore the significance of serology tests in cancer diagnostics. Serology tests have an established and crucial role in screening and diagnosis. Examples such as PSA for prostate cancer or CA-125 for ovarian cancer have become integral components of initial screening protocols, contributing to their widespread adoption and utilization. Additionlly, the cost-effectiveness and accessibility of serology tests play a pivotal role in their market dominance. Compared to some molecular tests, serology tests are often more affordable, making them economically viable for a larger patient population. The readily available nature of these tests further enhances their accessibility, aligning with the goal of widespread adoption in diagnostic procedures.

Moreover, the non-invasive nature of serology tests contributes significantly to their prevalence. These tests typically require a simple blood draw, presenting a less invasive alternative compared to certain biopsy or imaging procedures. The non-invasive aspect not only contributes to patient comfort but also increases acceptance rates for diagnostic testing. The dominance of serology tests in the market is driven by their established role in screening and diagnosis, cost-effectiveness, accessibility, and the non-invasive nature of the tests. These factors collectively position serology tests as a cornerstone within the broader landscape of cancer diagnostics.

By End-use: Hospitals presently command the largest market share, accounting for approximately 70%, despite the rapid growth of laboratories. This dominance within the market can be attributed to several key factors that underscore the pivotal role of hospitals in the landscape of cancer diagnostics. Hospitals boast established infrastructure and a substantial patient base. Equipped with well-maintained facilities and a pool of trained personnel, hospitals serve a large population requiring diverse cancer diagnostics. The inherent combination of resources positions hospitals as a major driver within the market. Additionally, the comprehensive diagnostic services offered by hospitals contribute significantly to their dominance. Hospitals provide a wide spectrum of diagnostic modalities, encompassing imaging, biopsies, and various laboratory tests. This diversity allows hospitals to cater to the varied diagnostic needs of a diverse patient population, consolidating their position as a primary choice for cancer diagnostics.

Moreover, the integration of diagnostic services with cancer treatment facilities within hospitals plays a crucial role. This integration provides a streamlined patient experience, potentially influencing diagnostic choices. The seamless transition from diagnosis to treatment facilitates a holistic approach to cancer care, enhancing the appeal of hospitals as preferred centers for comprehensive cancer-related services. Thus, the dominance of Hospitals in the market is driven by their established infrastructure, a substantial patient base, the provision of comprehensive diagnostic services, and the integration of diagnostics with cancer treatment facilities. These factors collectively position hospitals as key players within the broader landscape of cancer diagnostics.

By Region:

North America emerges as the dominant force in the Carcinoembryonic Antigen (CEA) market, driven by several key factors that collectively contribute to the region's market supremacy. The high incidence rates of cancer in North America play a pivotal role in its dominance. The region faces significant cancer prevalence, necessitating advanced diagnostic tools such as CEA for effective screening and monitoring. The heightened demand for cancer-related diagnostics positions North America at the forefront of the CEA market. Moreover, the presence of sophisticated healthcare infrastructure further solidifies North America's position. The region boasts state-of-the-art medical facilities, advanced diagnostic technologies, and a well-established healthcare ecosystem. This infrastructure enables the seamless integration and utilization of CEA testing, contributing to the region's dominance in the market.

Furthermore, high levels of patient awareness in North America significantly influence market dynamics. The population's awareness of the importance of early cancer detection and monitoring fosters a proactive approach to healthcare. As a result, there is a greater acceptance and utilization of CEA tests, bolstering North America's leading position in the market. Thus, North America's dominance in the Carcinoembryonic Antigen (CEA) market is attributed to the region's high cancer incidence rates, sophisticated healthcare infrastructure, and elevated levels of patient awareness. These factors collectively position North America as a key player in driving advancements and adoption of CEA-related diagnostics.

The Asia Pacific region is poised to experience the most rapid growth in the global Carcinoembryonic Antigen (CEA) market during the forecast period. Asia-Pacific is anticipated to witness the highest growth rate during the forecast period. Several key factors contribute to this projected growth, marking the region as a significant player in the Carcinoembryonic Antigen (CEA) market. The growing awareness among patients in the Asia-Pacific region plays a pivotal role in the anticipated market growth. Increased awareness of the importance of cancer screening and early detection encourages proactive healthcare-seeking behavior among the population, leading to a higher demand for diagnostic tools like CEA. Additionally, the high incidence rates of cancer in the Asia-Pacific region contribute to the expected growth. The region faces a notable burden of cancer cases, necessitating effective diagnostic solutions. As a vital biomarker, CEA is expected to play a crucial role in addressing the diagnostic needs of the growing patient population. Moreover, the existence of an advanced healthcare framework in the Asia-Pacific region further supports the projected growth. The region has been making strides in developing and enhancing its healthcare infrastructure, including diagnostic capabilities. This progress allows for the integration and utilization of advanced diagnostic tools like CEA, meeting the evolving healthcare needs of the population.

Thus, Asia-Pacific is poised to experience the highest growth rate in the Carcinoembryonic Antigen (CEA) market, fueled by factors such as growing patient awareness, high incidence rates of cancer, and the presence of an advanced healthcare framework in the region. These elements collectively position Asia-Pacific as a key contributor to the evolving landscape of CEA-related diagnostics.

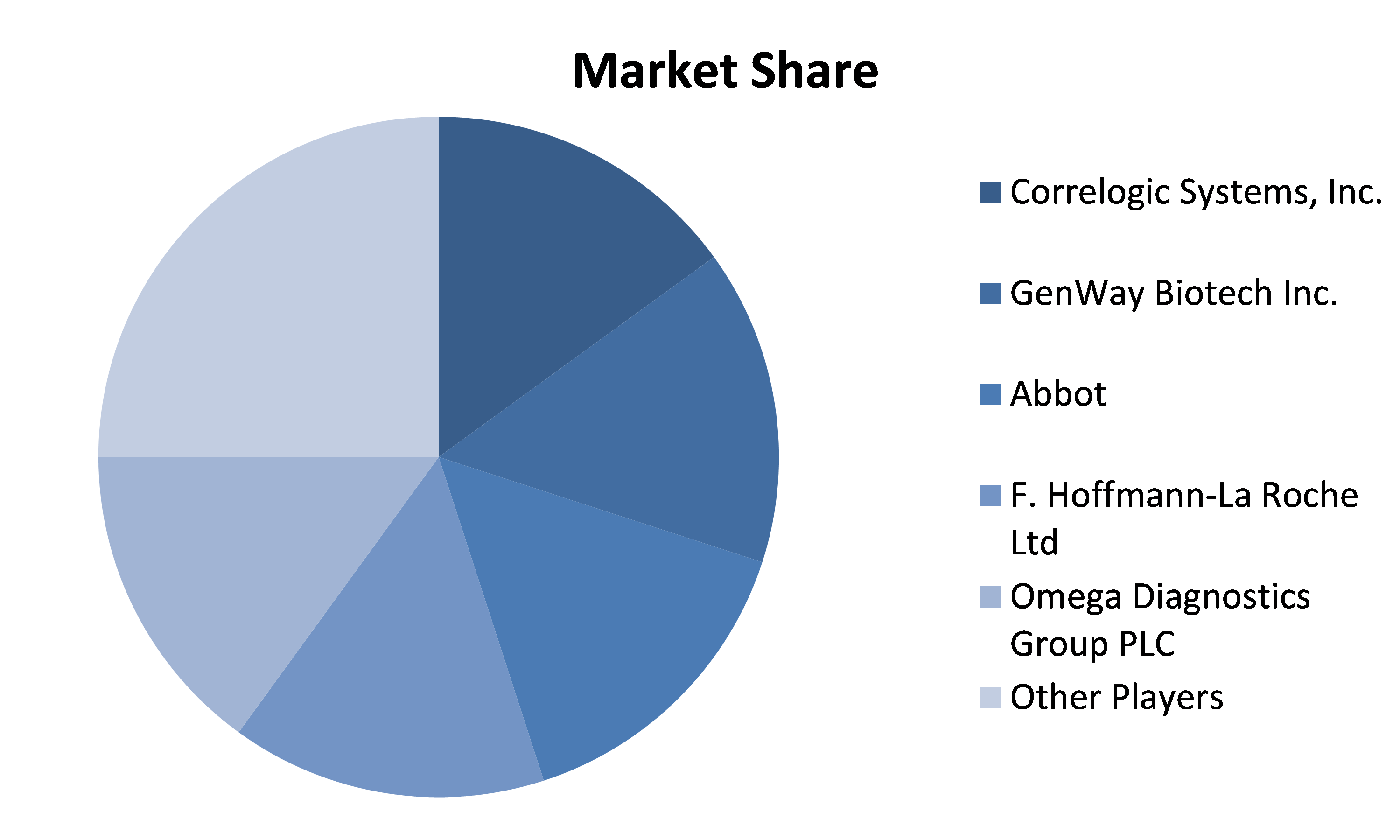

Competitive analysis and profiles of the major players in the Carcinoembryonic Antigen (CEA) market, such as Correlogic Systems, Inc., GenWay Biotech Inc., Abbot, F. Hoffmann-La Roche Ltd, Omega Diagnostics Group PLC, Boster Biological Technology, RayBiotech, Inc., Quest Diagnostics, Creative Diagnostics. Major players have adopted product launch and acquisition as key developmental strategies to improve the product portfolio of the Carcinoembryonic Antigen (CEA) market.

Market Scope and Structure Analysis

|

Report Metric |

Details |

|

Market Size Available for Years |

2021–2031 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2031 |

|

Forecast Unit |

Value (USD) |

|

Segments Covered |

By detected cancer type, test type, end-use, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

|

Companies Covered |

|

Key Segments Covered

Detected Cancer Type

- Colorectal Cancer

- Pancreatic Cancer

- Ovarian Cancer

- Breast Cancer

- Thyroid Cancer

- Others

Test Type

- Molecular Tests

- Serology Tests

End-use

- Hospitals

- Laboratories

- Others

Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Israel

- Rest of Middle East & Africa

TABLE OF CONTENT

- Research Methodology

- Desk Research

- Real-time insights and validation

- Forecast model

- Assumptions and forecast parameters

- Assumptions

- Forecast parameters

- Data sources

- Primary

- Secondary

- Executive Summary

- 360° summary

- By Detected Cancer Type trends

- By End-Use trends

- Market Overview

- Market segmentation & definitions

- Key takeaways

- Top investment pockets

- Top winning strategies

- Porter’s five forces analysis

- Bargaining power of consumers

- Bargaining power of suppliers

- Threat of new entrants

- Threat of substitutes

- Competitive rivalry in the market

- Market dynamics

- Drivers

- Restraints

- Opportunities

- Technology landscape

- Pipeline Analysis

- Regulatory landscape

- Patent landscape

- Market value chain analysis

- Strategic overview

- Carcinoembryonic Antigen (CEA) Market, by Detected Cancer Type

- Colorectal Cancer

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Pancreatic Cancer

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Ovarian Cancer

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Breast Cancer

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Thyroid Cancer

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Others

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Colorectal Cancer

- Carcinoembryonic Antigen (CEA) Market, by Test Type

- Molecular Tests

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Serology Tests

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Molecular Tests

- Carcinoembryonic Antigen (CEA) Market, by End-Use

- Hospitals

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Laboratories

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Others

- Market size and forecast, by region, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Hospitals

- Carcinoembryonic Antigen (CEA) Market, by Region

- North America

- Market size and forecast, by Detected Cancer Type, 2022-2031

- Market size and forecast, by Test Type, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Market size and forecast, by country, 2022-2031

- Comparative market share analysis, 2022 & 2031

- U.S.

- Market size and forecast, by Detected Cancer Type, 2022-2031

- Market size and forecast, by Test Type, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Canada

- Market size and forecast, by Detected Cancer Type, 2022-2031

- Market size and forecast, by Test Type, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Europe

- Market size and forecast, by Detected Cancer Type, 2022-2031

- Market size and forecast, by Test Type, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Market size and forecast, by country, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Germany

- Market size and forecast, by Detected Cancer Type, 2022-2031

- Market size and forecast, by Test Type, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- UK

- Market size and forecast, by Detected Cancer Type, 2022-2031

- Market size and forecast, by Test Type, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- France

- Market size and forecast, by Detected Cancer Type, 2022-2031

- Market size and forecast, by Test Type, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Spain

- Market size and forecast, by Detected Cancer Type, 2022-2031

- Market size and forecast, by Test Type, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Italy

- Market size and forecast, by Detected Cancer Type, 2022-2031

- Market size and forecast, by Test Type, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- North America

-

-

- Rest of Europe

- Market size and forecast, by Detected Cancer Type, 2022-2031

- Market size and forecast, by Test Type, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Rest of Europe

- Asia Pacific

- Market size and forecast, by Detected Cancer Type, 2022-2031

- Market size and forecast, by Test Type, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Market size and forecast, by country, 2022-2031

- Comparative market share analysis, 2022 & 2031

- China

- Market size and forecast, by Detected Cancer Type, 2022-2031

- Market size and forecast, by Test Type, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- India

- Market size and forecast, by Detected Cancer Type, 2022-2031

- Market size and forecast, by Test Type, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Australia

- Market size and forecast, by Detected Cancer Type, 2022-2031

- Market size and forecast, by Test Type, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Rest of Asia Pacific

- Market size and forecast, by Detected Cancer Type, 2022-2031

- Market size and forecast, by Test Type, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Latin America

- Market size and forecast, by Detected Cancer Type, 2022-2031

- Market size and forecast, by Test Type, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Market size and forecast, by country, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Brazil

- Market size and forecast, by Detected Cancer Type, 2022-2031

- Market size and forecast, by Test Type, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Mexico

- Market size and forecast, by Detected Cancer Type, 2022-2031

- Market size and forecast, by Test Type, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Argentina

- Market size and forecast, by Detected Cancer Type, 2022-2031

- Market size and forecast, by Test Type, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Rest of Latin America

- Market size and forecast, by Detected Cancer Type, 2022-2031

- Market size and forecast, by Test Type, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Middle East and Africa

- Market size and forecast, by Detected Cancer Type, 2022-2031

- Market size and forecast, by Test Type, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Market size and forecast, by country, 2022-2031

- Comparative market share analysis, 2022 & 2031

- UAE

- Market size and forecast, by Detected Cancer Type, 2022-2031

- Market size and forecast, by Test Type, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Saudi Arabia

- Market size and forecast, by Detected Cancer Type, 2022-2031

- Market size and forecast, by Test Type, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Israel

- Market size and forecast, by Detected Cancer Type, 2022-2031

- Market size and forecast, by Test Type, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- South Africa

- Market size and forecast, by Detected Cancer Type, 2022-2031

- Market size and forecast, by Test Type, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Comparative market share analysis, 2022 & 2031

- Rest of Middle East and Africa

- Market size and forecast, by Detected Cancer Type, 2022-2031

- Market size and forecast, by Test Type, 2022-2031

- Market size and forecast, by End-Use, 2022-2031

- Comparative market share analysis, 2022 & 2031

-

- Company profiles

- Correlogic Systems, Inc.

- Business overview

- Financial performance

- Product portfolio

- Recent strategic moves & developments

- SWOT analysis

- GenWay Biotech Inc.

- Business overview

- Financial performance

- Product portfolio

- Recent strategic moves & developments

- SWOT analysis

- Abbot

- Business overview

- Financial performance

- Product portfolio

- Recent strategic moves & developments

- SWOT analysis

- F. Hoffmann-La Roche Ltd

- Business overview

- Financial performance

- Product portfolio

- Recent strategic moves & developments

- SWOT analysis

- Omega Diagnostics Group PLC

- Business overview

- Financial performance

- Product portfolio

- Recent strategic moves & developments

- SWOT analysis

- Boster Biological Technology

- Business overview

- Financial performance

- Product portfolio

- Recent strategic moves & developments

- SWOT analysis

- RayBiotech, Inc.

- Business overview

- Financial performance

- Product portfolio

- Recent strategic moves & developments

- SWOT analysis

- Quest Diagnostics

- Business overview

- Financial performance

- Product portfolio

- Recent strategic moves & developments

- SWOT analysis

- Creative Diagnostics

- Business overview

- Financial performance

- Product portfolio

- Recent strategic moves & developments

- SWOT analysis

- Other Prominent Players

- Business overview

- Financial performance

- Product portfolio

- Recent strategic moves & developments

- SWOT analysis

- Correlogic Systems, Inc.

Segmentation

Key Segments Covered

Detected Cancer Type

- Colorectal Cancer

- Pancreatic Cancer

- Ovarian Cancer

- Breast Cancer

- Thyroid Cancer

- Others

Test Type

- Molecular Tests

- Serology Tests

End-use

- Hospitals

- Laboratories

- Others

Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Israel

- Rest of Middle East & Africa

Methodology

Get your pre and post sales queries resolved by our Subject matter experts.

We will assist you to customize the report to fit your research needs.

Our prime focus is to provide qualitative and accurate data.

Feel free to order a sample report before purchase.

Your personal and confidential information is safe and secured.

© 2024 Cognate Lifesciences. All Rights Reserved.